News

No Tax Identification Number, no bank account, according to 2021 Finance Bill

The Finance Bill 2021 has made it mandatory for commercial banks to demand Tax Identification Numbers (TIN) before an account is opened with them.

It also allows banks to demand TIN from existing customers who wish to continue to operate their accounts.

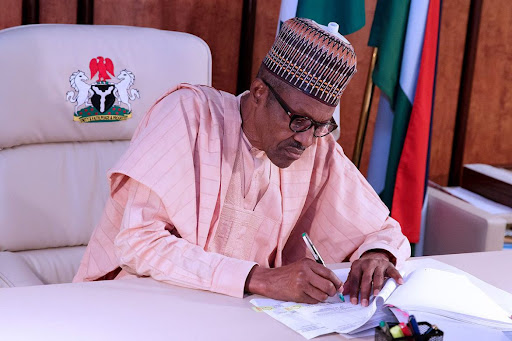

Plans by President Muhammadu Buhari to amend some of the tax laws in the country for improved revenue generation came to the fore Wednesday. Dec. 8, during consideration and passage for second reading of the 2021 Finance Bill.

The bill, which was received by the Senate Tuesday, got expeditious consideration by scaling first and second reading at plenary on Wednesday.

Speaking on Wednesday in his lead debate on the Finance Bill sent to the National Assembly by President Buhari, the Leader of the Senate, Yahaya Abdullahi, said: “Banks will be required to request for Tax Identification Number before opening bank accounts for individuals, while existing account holders must provide their TIN to continue operating their accounts.”

He also said the bill made electronic mails as the only channel that tax authorities would accept as a formal means of correspondence with taxpayers;

He added that the proposed bill prescribes penalty for a failure to deduct tax. He said it would also apply to agents appointed for tax deduction.

Abdullahi said: “This penalty is 10 per cent of the tax not deducted, plus interest at the prevailing monetary policy rate of the Central Bank of Nigeria.

“The conditions attached to tax exemption on gratuities have been removed.

“Therefore gratuities are unconditionally tax exempt.

“The duties currently performed by the Joint Tax Board as relates to administering the Personal Income Tax Act, will now be performed by the Federal Inland Revenue service.

“This seems to be an error in the process of amendments to replace the word ‘Board’ as it appears in Federal Board of Inland Revenue.”

He said the penalty for Value Added Tax late filing of returns increased to N50, 000 for the first month and N25, 000 for subsequent months of failure;

Abdullahi said: “The penalty for failure to register for VAT is reviewed upwards to N 50,000 for the first month of default and N25,000 for each subsequent month of default.

“The penalty for failure to notify FIRS of change in company address to be reviewed upwards to N50,000 for the first month of default and N25,000 for each subsequent month of default.

“This penalty also covers failure to notify FIRS of permanent cessation of trade or business.

“Quite significantly, the Finance Bill seeks to introduce sweeping changes to the tax laws covering seven different tax laws.

“Many of the changes are expected to have positive impacts on investments and ease of paying taxes especially for MSMEs.

“Going forward, we hope that changes to the tax laws will be on an annual basis to ensure that Nigeria’s tax system continues to evolve in line with economic conditions.”